Since a lot of young people started working online remotely, Safaricom partnered with PayPal to make it easier to withdraw money from PayPal to M-PESA.

The service is facilitated by TransferTo – a business-to-business (B2B) payment company.

in this article, I cover both Safaricom’s Thunes and Equity’s PayPal to M-Pesa services.

Key Takeaways

- Safaricom’s PayPal to M-PESA service is the fastest and can take between 5 minutes and 2 business days. The charge is 3% of the transaction amount.

- An alternative is Equity Bank’s service which is also instant and takes about 2-5 minutes. It has a maximum charge of 1.5% of the transaction amount.

- Ensure all details are correct when linking different accounts with PayPal. Wrong details can lead to account limitation or suspension.

- You can withdraw funds that have been limited for over 180 days using a US bank account such as the one offered by Payoneer.

Before we get into it, you can also read on Specific Ways To Earn Online in Kenya.

The Process to Withdraw Money from PayPal to M-PESA THUNES

You need two things. First, an active and registered M-PESA line. Second, a PayPal account. To be ready for a withdrawal, take the following steps:

- Ensure you own a registered M-PESA line. You can visit an M-PESA agent to get registered and activated to use M-PESA.

- Verify that your PayPal details match those on your M-PESA line. They should also match those on your bank account (more on this later).

- Link your M-PESA number to your PAYPAL by visiting https://www.paypal-mobilemoney.com/m-pesa.

- The linking process just needs you to log in and add your phone number.

After your accounts are linked, you can follow these next steps to make a withdrawal at any time:

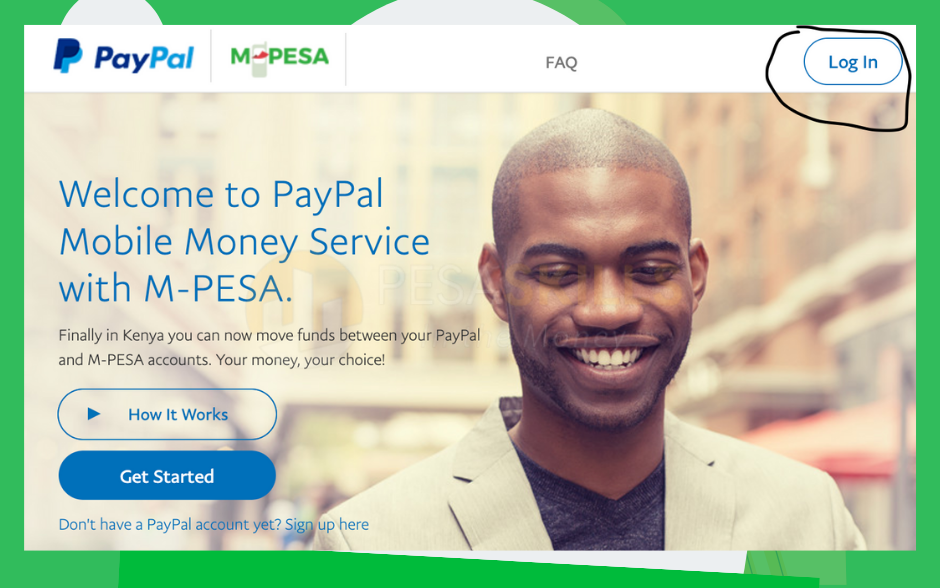

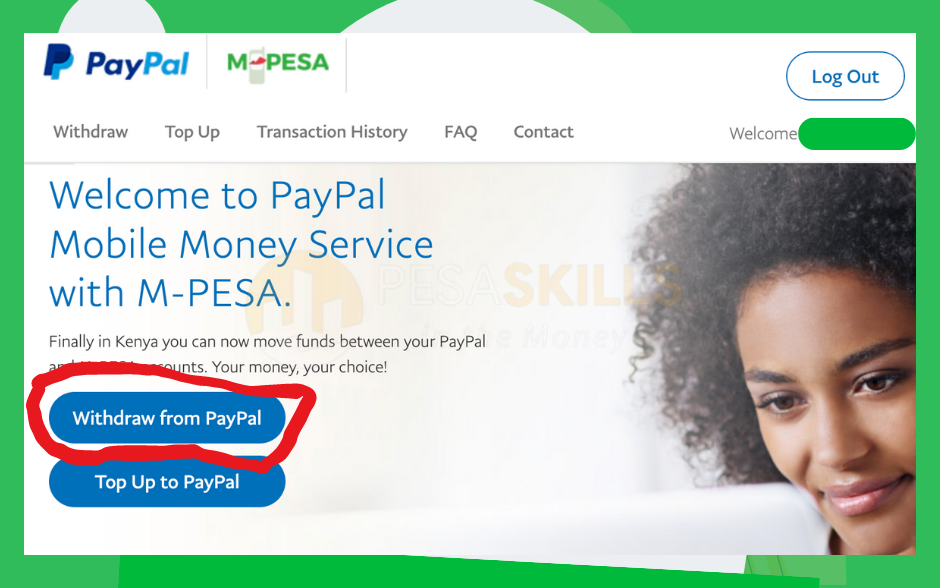

- Log in to the transfer platform via the link https://www.paypal-mobilemoney.com/m-pesa.

The login page should be similar to the one below.

- Enter the amount you wish to withdraw from your PayPal in USD (US dollars).

Click on the “Withdraw from PayPal” button.

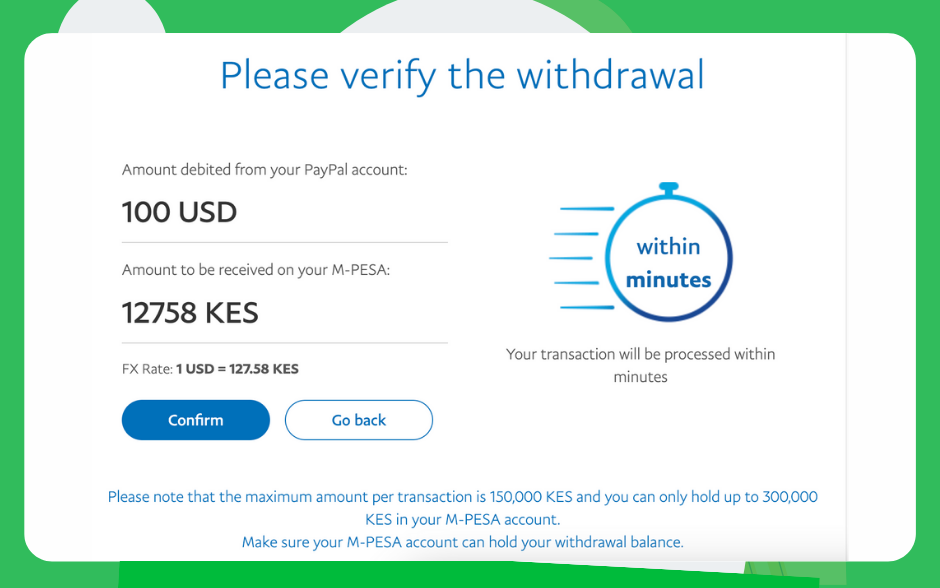

- You will be taken to the next page where you will be shown the conversion rate from USD to KES (Kenyan Shillings).

The page looks like the one below.

- Confirm the withdrawal. You will be directed to a confirmation page that specifies how long it will take for the amount to reflect in your M-PESA account.

The confirmation looks like the one below.

- On the email you used for PayPal, you will get an email saying “You Authorized a Payment of $xxx to THUNES”.

How Long Does PayPal to M-PESA Take?

Depending on the amount withdrawn, the transaction can take anywhere between 5 minutes and 3 calendar days to be processed.

In most cases, amounts below $500 can take just a few minutes while anything above $500 can take 2 days.

It also seems that Safaricom changes the processing time based on the volume of transactions. So, sometimes withdrawing money at odd hours works better.

Does PayPal to M-Pesa Charge?

Yes. Safaricom charges a few of 3% of the amount withdrawn for each transaction.

Also, while not a direct charge, you should know that the exchange rate varies and can cause changes in the amount that ends up in your M-PESA account.

Luckily, this exchange rate is shown to you before you confirm the withdrawal.

What Are Other Ways to Withdraw Money from PayPal in Kenya?

An alternative to using Safaricom’s PayPal service is Equity Bank’s PayPal service.

How to Withdraw Money from PayPal to Equity Bank Account

Equity Bank has offered PayPal withdrawal services for several years now and their process has remained the same.

You must have an Equity Bank Account.

To withdraw money from PayPal via equity bank, follow these steps:

1. Register on the Equity Self-Service Portal

Go to the Equity Bank self-service portal – https://selfservice.equitybankgroup.com/login – and register. The registration process is very easy.

First, enter your personal details making sure that your email address and phone number are entered correctly.

Create a strong password. The bank emphasizes using an alphanumeric password that has a capital letter, a number, and a special character.

Enter your one-time password (OTPS) when prompted. It will be sent to your phone number. Then click on “Complete Registration”.

2. Log in to the Self-Service Portal

After the registration, log back into the portal using the email and password that you created in the first step above.

You will see the option to link your bank account. Enter your account number first. You will be sent a confirmation OTP to your phone. Enter that OTP and you will have successfully linked your account to your phone number.

3. Link your Equity Bank account with your PayPal account

Click on the PayPal logo inside the bank’s self-service portal dashboard.

Enter your PayPal details and select the bank account you want to link your PayPal to.

Allow the Pop-Up message. If you reject the Pop-Up you will have to start the process all over again.

Click on “Authorize” to allow Equity Bank to view your PayPal balance and transfer funds from your PayPal to your Equity Bank account.

You will get a confirmation in your email.

4. Making a Withdrawal from PayPal to Equity Instantly

Click on “Withdraw Service”.

Fill in the short form with details of the PayPal account and Amount.

Click “Accept” and wait for a few minutes for the funds to reflect in your Equity Bank account.

How Much Does It Cost to Withdraw from PayPal to Equity Bank?

For withdrawal via Equity Bank, the following charges apply:

Equity Bank’s PayPal withdrawal charges are therefore cheaper than Safaricom’s service and recently, they have updated their process to allow for instant transactions just like Safaricom’s Thunes which can take about 5 minutes.

Therefore, Equity Bank’s withdrawal service is a great alternative to those who find Safaricom’s service limiting due to relatively low currency conversion rates.

How Do I Unlink my PayPal Account from Equity Bank?

In case you want to remove your Equity Bank account from PayPal, follow these steps:

- Log in to PayPal and go to Payment methods

- Click on the bank account you want to remove.

- Select “Remove bank”

Which Banks Support PayPal in Kenya?

Most of the major local banks in Kenya support PayPal transactions and can be linked to PayPal. These include:

- Equity Bank

- KCB Bank

- Stanbic Bank

- Cooperative Bank

- NCBA Bank

- ABSA Bank

It is important to note that while some banks like ABSA and KCB allow you to link their cards with PayPal, they do not have the withdrawal feature. This means you cannot withdraw funds from PayPal to your bank account but you can use the card to make payments via PayPal.

Equity Bank is the only local bank that has seamless withdrawal and funding of PayPal accounts.

Why Can’t I Withdraw from PayPal to M-PESA?

There are several reasons that your withdrawal from PayPal can refuse to go through. Let’s look at each one separately:

- PayPal to M-PESA Transaction Under Review

After withdrawing via Mpesa, you get a text message that the transaction will take a few minutes; “within minutes”. However, sometimes you will get another message saying the transaction is under review.

Do not panic. PayPal will often review transactions that seem suspicious due to rampant fraud on its platform. Just give them time to assess your transaction.

If they do not release the funds to your Mpesa or back to your PayPal within 2 days, you can call them directly via the number on PayPal’s “Contact Us” page.

- PayPal Account Access Limited

Again, due to persistent fraud, PayPal tends to limit accounts if they suspect fraudulent transactions could be happening.

If your account is limited, you can call them or contact them via Facebook’s Inbox feature.

Also, to avoid limitations, you can call PayPal whenever you expect a large transaction and let them know in advance that the transaction will happen.

You may also wonder why PayPal is Limiting Accounts in Kenya. Well, a few years back, Kenya – and Africa in general – witnessed a lot of PayPal fraud including credit card fraud done using multiple accounts under one person. As part of their measures, they began restricting accounts and requiring users to link their accounts to a bank.

(You can read the article I wrote explaining similar fraud titled “Sim Swap Fraud and the M-PESA Scam“)

Your account can also be limited if PayPal wants to verify your identity.

When they do that, they will request for your most recent bank statement and a photo of your national ID.

Provide the details as soon as you can and wait. Usually, they will lift the limitation in a few hours.

- PayPal Account Suspended

Your account can be suspended for using a fake email address or for persistent complaints from other users – especially fund reversals.

If your account is suspended, you can contact PayPal and try to negotiate with them. They have the Resolution Center page where such appeals happen.

Another common cause of suspension and possible banning is opening two PayPal accounts with one email.

- PayPal to M-Pesa withdrawal Error while processing request

A high chance is that the error message “Error while processing request. Please try again or talk to our support” is caused by changing IP addresses when making a withdrawal.

To avoid it, do not switch internet points or use a VPN during the withdrawal process.

If the problem has already occurred, just wait for 24 hours and try again.

If the problem persists, check that the details you gave on your PayPal account match those on your M-Pesa account and even on your bank account.

How to Withdraw Money from PayPal after 180 days in Kenya

In some cases, it is possible to withdraw money from limited PayPal accounts after 180 days.

To do this, you need a working Payoneer account. Sign up for the account here – www.payoneer.com.

Once you have your Payoneer account ready:

- Log in to the Payoneer account

- Go to the “Receive” tab and then the “Global Payment Service” tab below it.

- Click on the “Community Federal Savings Bank” – this is the US bank account that Payoneer issues you upon request.

- Copy the details of the account like account number, routing number, etc.

- Log in to your PayPal account and click on “Initiate Transfer of Funds” from the Pop-up, and click on “Link a bank”.

- Enter the details that you copied from Payoneer and link the account to PayPal.

- Go back to the “Initiate Transfer of Funds” tab and this time select the “Community Federal Savings Bank” as the transfer destination.

- Click on “Next”, enter the transfer amount, and click on “Next” again.

- You’ll be taken to the “Quick security check” page where you will need to receive a text message to confirm your identity.

- Once you enter the code, you will be redirected to the page “Review your transfer” where you can make the final confirmation.

- It will take 1 day for the money to reflect in your Payoneer account. You can then transfer it again to your local bank account.

This is however a very long route for making the withdrawal. An easier way is to call PayPal and provide them with the necessary details for them to remove a limitation from your account after 180 days have passed.

Looking for ways to make money online? Read the following articles I have written on:

- How Much TikTok Pays in Kenya

- How Much You Will Make as a YouTube Vlogger in Kenya

- Making Money on Fiverr Using 5 Simple Gig Tips

- Getting Well-paying International Tech Jobs from Kenya

- Verified Ways to Get Direct Clients

Conclusion

In conclusion, when it comes to transferring funds from PayPal to M-PESA, Safaricom’s service is the quickest option, with a processing time ranging from 5 minutes to 2 business days and a charge of 3% of the transaction amount.

However, if you are looking for a cheaper alternative, Equity Bank’s service is worth considering, as it has been updated for instant transfers and has a maximum charge of 1.5% of the transaction amount. It’s important to ensure that all account details are correct when linking with PayPal to avoid account limitation or suspension.

If you encounter limitations and have funds held for over 180 days, you can withdraw them using a US bank account, such as the one provided by Payoneer.