I started Pesaskills just to write articles that encourage smart investment among individuals and small-scale traders.

Key Takeaways

- To avoid getting stuck in the middle-class lifestyle, you have to be intentional.

- Lifestyle Creep can prevent you from having good investing habits.

- A long-term orientation can save you from bad career and investment decisions.

- Aim towards being financially independent and living meaningfully.

Pesaskills began as one of those ideas that bug you forever seeking to come out but with no concept of how they should be implemented.

This elusive game ran for a few months.

I already run a market research and consulting practice and for some reason, this idea did not fit into the regular consulting playbook.

I tried to think of it as a news blog but that also did not sit well with me because I wanted to do something more insightful and meaningful.

Finally, I decided on nudging small-scale investors. If for no other reason, than just to get a few people (and me) going on things business and non-salaried income.

So, the goal was set and I have been on this mission to target middle-class folks who will not let go of that tie for some rugged work even if it means a bit more money in their pockets and fuller hearts.

What particularly irks me about the idea of a middle-class life is that somehow it has been a resignation of a whole lot of Kenyans. Including young people.

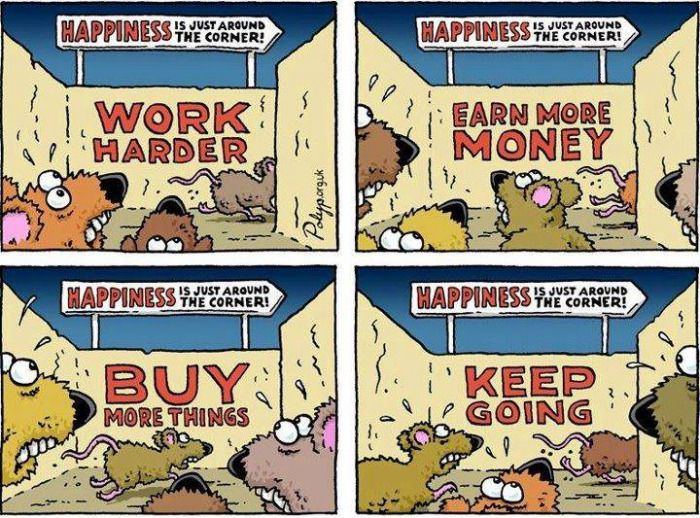

Intentionally or not, we tend to have the same damn cycles of life, fading ambitions, neglected talents, and abhorrible routines that continuously suck us in like a vortex.

In Kenya, 44.9% of us are middle-class households (that’s what the Kenya National Bureau of Statistics says). These households operate with anywhere between Kshs. 23,670 and Kshs 199,999 each month. So, in short, an average entry-level salary to a similarly average managerial salary.

The Dark Poetry of Middle-Class Lifestyle

Middle-class life is largely a series of almost automated decisions.

There is dark poetry behind it and here is how my prose would unfold.

I hand in my final school project, graduate with anything above second-class and after interning for a while I land my first job at 25. A job that probably so-and-so had to be called and a few strings pulled for me to get.

It will not matter that my passion is in writing and music. Or that I have business acumen. No! A career in procurement will seem fine because it is promising and there is a steady paycheck.

Society will paint this as the adult thing to do.

I will barely settle in this job before I take out some money – savings or loan – to move into my own house.

Of course, I want to move in style so I will pick an envious neighborhood, and buy pricey furniture and electronics all within the first few months of employment. It will probably take more than a year to have everything in place but it will be worth it because of the approving nods from friends who visit.

Several months in and hundreds of taxi rides later I will decide I need a car.

It will feel like the only piece missing. At this point, I will have a whole network of friends that help kill the long weekends. Those sinful weekends in Naivasha. Taking a car loan will be the “right” thing to do and so after being approved I will rock the newest Subaru in the market. Big boy status kicks in and now everything else elevates (aka lifestyle creep). I eat and shop at places with parking and move to a bigger house in a neighborhood that I will be convinced suits my car-owning status.

A fast life will kick in immediately.

Single, free and moneyed means turning up at every possible opportunity, making drives back home at 2 am from clubbing, concerts with babes and the boys, having weekends away from the busy city, and pointing at people with car keys.

I will be almost 30 with most money going to rent, fuel, nyama, women, men, garages, and occasionally towards savings. I will however not invest.

I will regret every weekend of wasted money but I will promise myself that the next paycheck will be for buying Safaricom shares. Only that this next paycheck gets spent before it settles in the bank.

At around 30 I will grow weary of being alone and due to pressure from all over the place, including the ancestors, I will finally give a ring to my girl. It will be a quasi-fancy proposal because I would now feel that I should not blow away money on “unimportant” things.

I will however bundle together some savings and a ka-small loan and do a big wedding and then plaster the pictures all over social media. Planted on leather couches, we will incessantly scroll through the comments while liking them and laughing together. Everyone will be so impressed and they will wonder how we pulled off such a grand wedding. We will say it is by “Grace”.

Life will move quickly after thirty.

Quarter life crisis will have settled down and I will be thinking of taking my career to the next level. I will also want more for my family. A kid or two later, a master’s degree financed via another loan and a professional certificate, I will find my way into a management position. It will seem better but this will be version 2.0 of a fast life.

I will take a loan for a family car (just a big car that suits my management status) and move again to a family-friendly community.

I will shop and eat at even fancier places and admit my kids to a school with an IGCSE system. Things will mysteriously pile up and I will be taking salary advances just to keep the family moving. The idea of owning a house, even a ramshackle one, somewhere outside the city will follow me like a stalker in the dark. But I will convince myself that all will be okay.

And then reality will hit me the same way sleep does, slowly then all at once.

I will loathe the fact that only XXXL shirts fit me now after a million and one days of eating beer and meat every evening and all weekend. I will be scared that I have not found a way to save enough school fees to put the little ones through university leave alone have a solid retirement plan. I will regret all the money, the loans, and the opportunities that I blew away.

A few deliberations with myself and I will get a mortgage, against better judgment, because a house will make me feel better. I will also finally invest. A small business to help ease the pain of a mortgage but because I will be too busy with work and too big to run it, it will fail within the year.

Work will have become unbearable but I will push hard because one missed call from the boss and my family could sink into the bottomless pit of poverty.

I will sell myself to my work both to avoid the problems at home and to try to secure the remaining laps of my career. I will drink to numb the stupid day-to-day cycles and then silence the howling emptiness of my soul. I will seem fine but I will occasionally stare into the abyss wondering why I couldn’t just stick to writing or music or run a business.

All of a sudden jumping off a building will not seem like such a bad idea. But I will also not do that.

I will grow to be reckless.

Chase after younger women, drink a lot more and lose my control and temper once in a while. A little at first then a bit more every time. Family problems will inevitably come and she will seem like the devil himself but I will be the actual devil. We will argue late into the night and curse our marriage in the morning. My emptiness will drain her and she will leave.

I will drink some more.

Nothing will be fulfilling.

That fulfillment bus will have ridden away long before when the regrets first set it. Depression will lurk around like a vulture and alcohol will open the door.

Desperation will make me erratic and bad luck will have me in the ICU after swerving into a 26-wheeled trailer at hellish speeds. The beeping of the machines will then fade away as if signaling the end of my ill-fated middle-class life.

In a few years, it will not matter that I existed. Even to my family.

That’s how the poem could read. Yeah! Dark and unsettling.

It is time to admit that there is more than being robots in the rat race of middle-income Kenya. Pesaskilss is just one avenue that will nudge you towards your own financial freedom but you have to find other ways too. Be bold in building your wealth.

Save, invest, be independent, pursue your passions, and live meaningfully. Preferably in that order.

Shall we?